Raising Money for Surgery for an Impoverished Chinese Teenager

Part of the magic of China is expressed in the phrase yuan fen (缘分) which refers to seemingly accidental encounters that have destiny behind them. So many of the miracles I have experienced in China are tied to this concept. So many of the rich friendships I now enjoy here began as chance encounters.

One of these chance encounters happened a few weeks ago in Shanghai, leading me to become friends with a poor family of Chinese farmers from a distant province that I many never see. But on my way back to the office after lunch at a good Chinese restaurant, my eyes were drawn to a father and his little son whose leg was badly deformed. The boy could walk, but the way his leg curved outward to the side instead of going straight up and down made it look like it would snap under the weight of his thin body. Every time he stepped with his bad leg he had to stoop halfway to the ground in a difficult motion.

What a burden this must be, I thought, and wondered if they had seen a doctor. I couldn’t let that thought go, and spent several minutes trying to argue myself out of doing anything. But I ended up following them for about 100 yards. Do I dare approach them? They looked like they were from the countryside, and I worried that they wouldn’t speak Chinese that I could understand. Won’t I just embarrass them and make things work? I struggled to know if I really should step forward, and in fear and uncertainty wished not to, but try as I might to just turn around and go back to work, I felt I had to do something. So I finally approached them, and, as if it were somehow my business, asked the father about the boy’s leg. The father spoke too quickly and with what seemed like a difficult accent to me, and my Chinese is still often inadequate when people speak even it’s pronounced clearly in standard dialect, but to my delight, another person with them, a college student, the cousin of the young boy, spoke excellent English and was able to fill in the gaps.

It’s a long story, but the father and the boy were here in Shanghai to finally get medical help. The boy had a terrible infection as a baby that made his knee swell terribly, and after that, his leg was bent horribly. He had some kind of surgery at age 3 but it didn’t help much. Now the father was determined to get his son some help at a much better hospital than the countryside offered. He was acting on pure faith, in my opinion, determined to help his son, but had just gotten the bad news from the hospital that surgery would cost well over 100,000 RMB, but he was going to have it done and find some way to pay.

I think a big part of why I needed to get involved was to help them recognize the need for a second opinion. I helped them see an excellent and experienced physician at a leading hospital who explained what was wrong with the recommendation of the first doctor he had seen. The first doctor wanted to operate on the hip and the knee at the same time, but the hip surgery, including an artificial hip, should wait until the boy’s bones had quit growing. Doing that surgery now could greatly complicate recovery and make things worse.

The father wasn’t entirely convinced, but then I arranged for two very kind LDS doctors in the States to look at the x-rays and photos and offer their comments, and they gave further clarity into the problems with hip surgery now. Perhaps a result, the father made what I think and hope is the better decision. That may be the main purpose for my involvement in this case. But it may not be the only reason.

As I write, the boy is about to wake up from a several hours of complex surgery. This surgery costs 50,000 RMB, about $8,000. The father has been able to come up with 20% of that cost as a down payment. When the boy leaves in a couple of weeks, if all goes well, his father will need to make the rest of the payment. He isn’t sure how he will do that, but I admire his faith. I’m hoping, with the help of some of you, perhaps, to raise some funds to make that goal reality. If you are interested in helping this brave family get their son back on his feet, let me know at jeff at jefflindsay.com. Think of it as your chance to make a difference in China and help a boy with vast potential live a better life.

Here are some related photos, shared with permission.

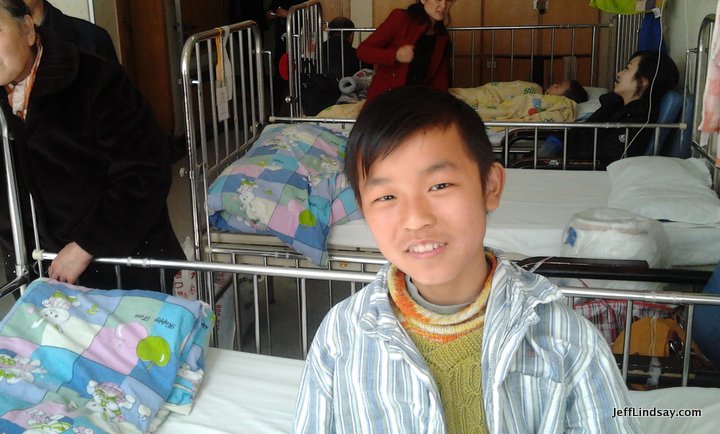

Zhiwei awaiting surgery, sitting on the bed in a crowded room of six beds at Shanghai hospital where he will spend the next two or three weeks recuperating, if all goes well. (Not the Children’s Medical Center.)

The boy’s bad leg, photographed at Shanghai Children’s Medical Hospital, where the family got a second opinion on the originally recommended surgery.

A recent x-ray taken at Shanghai Children’s Medical Center.

Zhiwei walking before surgery.

Walking before surgery. I’m praying that there will be a significant improvement after surgery!

Update, Sunday, March 24, 2013, 8 pm: Tonight my wife and I just visited Zhiwei and his father tonight at the hospital. The boy is in a lot of pain and has no desire to eat. The father is worried for him. The mom will be coming tomorrow and that should help. I think she’s never been to Shanghai and is worried about how to get to the hospital. The father didn’t know how to tell her to get hear and was planning on just using a taxi, I’m afraid, which would be too expensive for them. We showed the father how to use the subway system nearby so he could tell her exactly what to do, how to but a ticket and how to get to the station and what exit to take, etc. This must have looked really strange to the locals as they watched two foreigners using Chinese to explain to a native Chinese man how to get around town. We’re always providing entertainment here in China–perhaps that’s our real purpose here.

The father said that Zhiwei’s resistance was low, but didn’t have a bad fever. Not quite sure what he meant by resistance. The skin isn’t doing well either around the wound. That good man is worried for his son. He hasn’t slept since coming here on Thursday, having watched over his son constantly and now he says he needs to massage his son’s leg or something every little while. Saw no doctor or nurse while we were there, and got the feeling that the man was feeling pretty alone, in spite of a crowd in the same room.

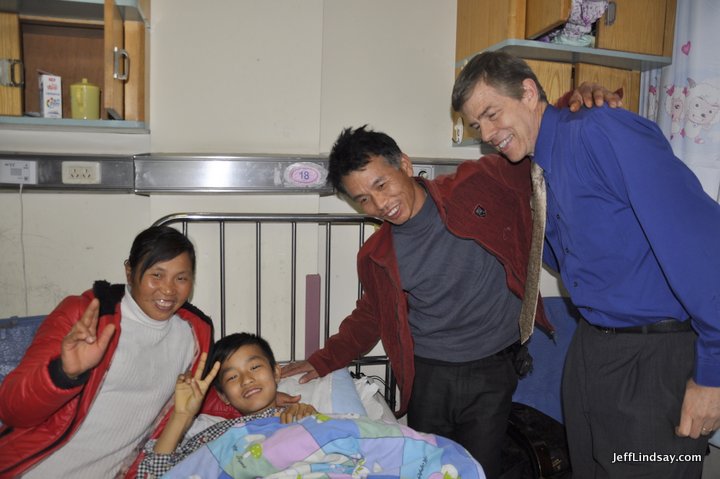

Update, March 26, 2013: The boy’s mother came into town yesterday. I went by the hospital briefly on my lunch break and she saw me for the first time as I stood at the door of the little room with 6 hospital beds packed together. She instantly knew I must be the strange foreigner she had heard about and broke into a huge smile. It seemed like we had already been friends when we met. What a warm and sweet woman she is. Even more gladdening, little Zhiwei was smiling, too. He’s eating and smiling and making progress. What a difference a mother makes!

Thank you for the donations! We still need more, but are so grateful for the kindness we’ve seen from people close and far away recognizing the need to help.

Update, March 30, 2013: Disaster! When I finally looked at the leg under the blankets, to my horror I saw that the surgery was on the hip, not the knee. WHAT? I was outraged. The doctor was supposed to be in the next day at 6 pm, so I came then, but he didn’t show up. During all my visits, I’ve never seen a doctor come in and do anything with the patients and their families in the crowded little room, and only once saw a nurse come in to drain a catheter or something on another teenage boy, a procedure that involved exposing his genitals to everybody in the room and the hallway. No sense of privacy at all. Ugh. Anyway, the father called the hospital staff and arranged for us to see the surgeon the next morning when he came in at 7:45. I was there, with a translator to help, and the doctor came in and just walked by us, radiating wealth and importance, with no time to discuss his work with peons like us. We were told he needed to change and would be with us in a minute. Then he escaped out of his office and went into another office down the hall, and then we were told he’d be just a few minutes and we’d have to wait until 8:00 a.m. That time came and went. It was clear he wasn’t interested in meeting or talking. What was he worried about?

The father then showed me the x-rays. Major hip surgery, with pins and rods. Will it help? I don’t know. The surgeon, the head of the department here, told the family that the hip was where the real problem was and now it will let the knee heal naturally. I’m not sure about that. A US doctor who has seen the x-rays before and after has raised serious questions about this procedure. There have been many red flags, including the fact that the surgeon told the family that something was wrong with the placement of things in the hip and that a second expensive surgery was needed next week. When the family said they didn’t have the money for that, the doctor said it was time to back up and leave because the bed was needed for the next patient. And now he’s saying no problem, it will heal naturally. Wait, if there’s a problem in what he did with the hip that required expensive surgery, how can he send them away and say he can heal naturally? How can he send them away at all? China leaves many questions unanswered.

Plan B: I want to raise $13,000 to pay for the next surgery and help them pay down a major part of the debt they have from this apparently failed surgery. Thank you to all who have donated, and I hope you can keep the donations coming. All the donations I’ve received so far and then some have gone to the family to help them with their expenses here, and now I want to build a reserve to help for another surgery in a few months, if that is the right timing.

Update, March 31, 2013: Yesterday we visited the family at Xinhua hospital and learned that they still did not have their medical records, but Kendra my wife was able to go there today while I was in Hangzhou and get the records and see them before they took the train out of Shanghai. Mom, Dad, and a cousin will carry Zhiwei into a taxi and from there onto the train. Jolts and bumps are inevitable, and the risk of damage and pain over the long trip home terrifies me. It’s over a 10-hour train ride to get close to home, and then I guess they’ll take taxis again. Then Zhiwei is supposed to lie on a bed for 3 months while the hip heals. Can that work? Will he walk any better after all this suffering? Probably not until he gets knee surgery. I’m praying that he will be able to walk at all.

Several kind donations came in today to help us toward the goal of raising enough for the real surgery that will be needed. We’ve resolved to go out to Jiangxi provinces ourselves, at the invitation of the family, to meet them there and see how they are doing. I think it will be a humbling trip. Much about China is humbling.

Why wouldn’t the surgeon talk with us? Why did he do the hip surgery instead of the needed surgery on the knee? Some of the answers might become clear in the medical records I’ve just received from my wife. Stay tuned.

Update, April 1, 2013: Farewell for Now

My new friends from Jiangxi Province in China have left the hospital and gone home. The surgery that was provided to the surprise of the family and me, possibly an unnecessary surgery, requires the boy to remain lying down for the next 3 months, according to the surgeon. But to get home, he had to be moved in and out of taxis, through a train station, and onto a train, where the best the family could find was a “hard sleeper” seat where the boy can lie down, but it’s an elevated seat about 5 feet above the ground that people normally climb to reach. The parents were were hoping to lift up and place him there. I guess it worked out somehow. I’d probably cringe if I knew the details. He is home now, and from the father’s text message appears to be OK, but I’m sure there were some ugly jolts and terrible pain along the way. I hope nothing was damaged.

I saw the family last on Saturday, March 30th, the day before they took the long train (11 hours) back to their town in Jiangxi Province. Kendra, my wife, saw them the next day when I had to be in Hangzhou, and she brought them some pillows, another blanket, and some food that I purchased Saturday evening for them for the long journey home. It was be a painful ride, I’m afraid, for our little young man, Zhiwei, whose upper thigh bone was cut and bolted together in a surgery that may only delay the work needed on the knee. But perhaps it’s just what he needed most, I can only hope. There is a chance that the decision to operate that way was actually brilliant and perfect for him. Well, I’m hoping for a miracle. But I’m pretty sure he’s going to need to get that knee rebuilt. And that’s why I’m working to raise more money to be able to bring them back here and get things done right, if possible.

Here are some photos of our visit on Saturday, March 30. They have invited us to come visit them soon in Jiangxi, and we plan to do it. I think we’ll fly into Nanchang (very inexpensive!) and then take a train or taxi from there.

So strange, this chance encounter on the streets of Shanghai, and how it has changed me. It’s been quite an experience, this escalating drama and the process of learning to know, love, and mourn with a poor family family whose parents have a total of 3 years of education between them. Day after day, visiting, talking, experiencing the various cycles of relief and outrage, happiness and anger, resignation and resolve, well, I can feel that it’s changing me a little, changing the way I look at people, money, and society. Somehow, this random encounter has mattered deeply to me. It’s yuanfen, a touch of destiny I think. But perhaps much that actually is chance offers the opportunity to grow and learn and love in ways that will seem like destiny. Random or not, destiny or not, I feel my life is linked to some distant souls now that are part of who I am, and I must return and maintain this friendship and this responsibility. They are somehow like family how.